UmbrellaX - Delegator Liquid Staking Pool Token

INDUSTRY PROBLEMS

➡ Many Web3 users lack the insight to optimally strategize their portfolio ➡ Web3 users need a way to simplify the general process of purchasing crypto

➡ A Decentralized vehicle to gain exposure to top cryptocurrencies is needed

➡ Web3 users need a way to analyze risk management within the Web3 market

Why UmbrellaX (USP Propositions )?

➡ UmbrellaX offers a variety of indexes that are based off of risk models,aiding in assessing various Risk appetites ➡ With our cutting edge technology, we have done extensive due diligence and market research to ensure we deliver the best indexes for our community

➡ UmbrellaX offers a variety of indexes that are based off of risk models, aiding in assessing various risk appetites

➡ Index portfolios streamlines the process of broadening the exposure to a wider crypto market

➡ UmbrellaX empowers users with our community weighted index, gathered from the knowledge of our experienced supporters

TECH BEHIND All

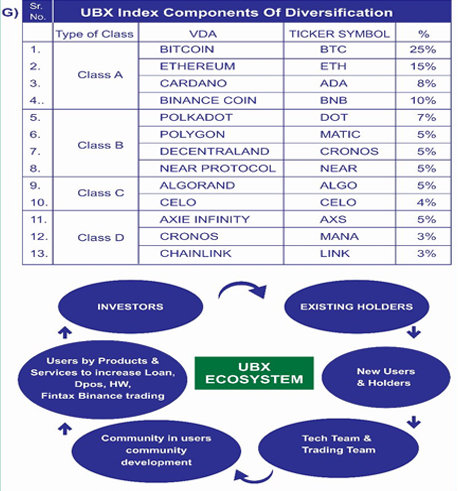

Defi Index Broad Exposure, One Token ➡ Our indexes track the progress of the entire digital finance space. UmbrellaX offers quick and easy exposure through one token, simplifying upside to the fastest growing sectors in DeFi. UmbrellaX Liquidity Fund Token

➡ A collection of index baskets, including DeFi, blue chip, NFT, gaming, zk rollup, to name a few. We offer portfolios to those of all experience levels and varying risk appetites. Staking DAO Governance

➡ The UBX token allows voting rights to network participants. Tokens holders play an important role in the cultivation of the community-decided index and decisions relating to the index protocol. Dynamic Fee Structure Market Volatility Resistance

Underlying assets included in the indices are selected by top market analysts with consideration to market capitalization, volume, liquidity, and other key indicators.

Phase 1

Phase 1  Phase 2

Phase 2  Phase 3

Phase 3  Phase 4

Phase 4  Phase 5

Phase 5